Out Of This World Info About How To Buy Inflation Protected Bonds

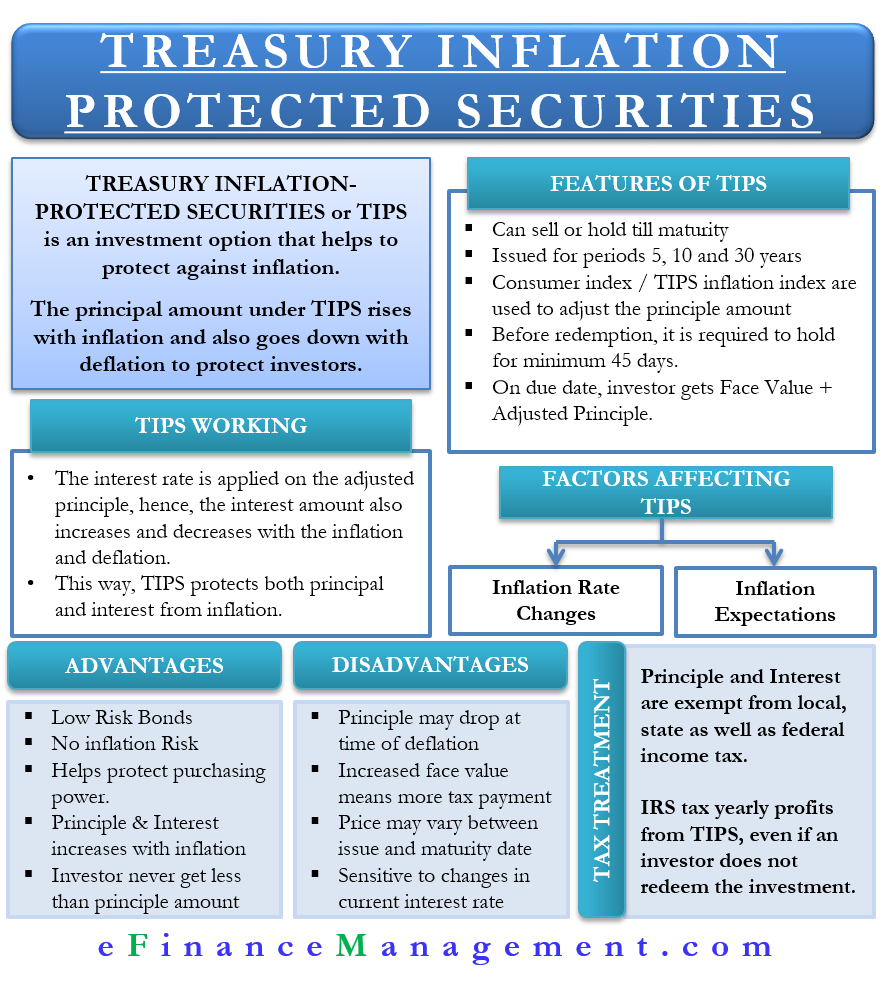

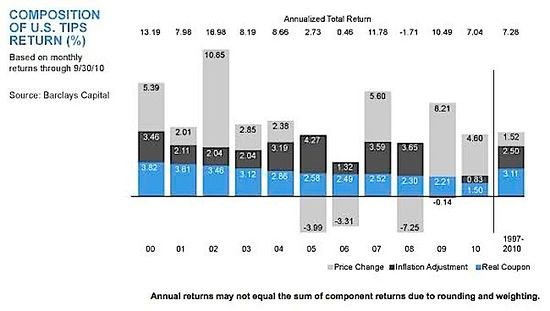

You invest $1,000 in a bond that pays 1 percent interest.

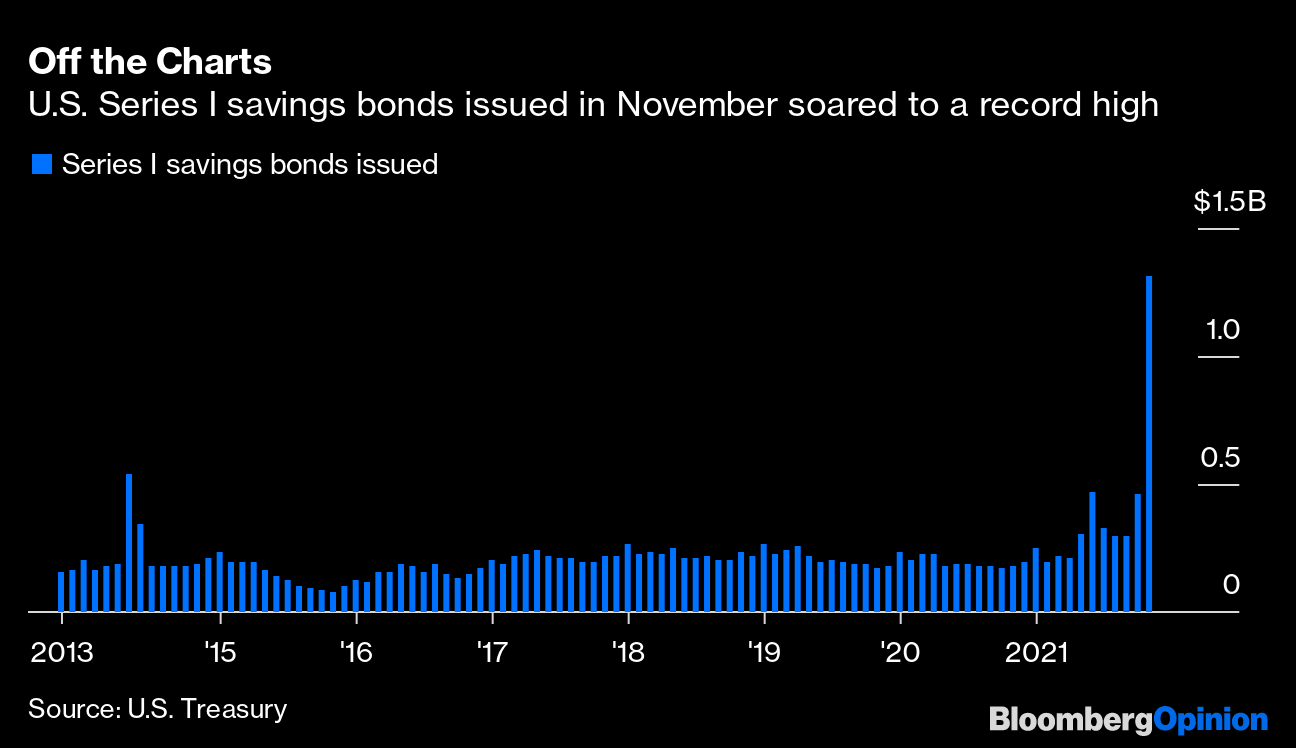

How to buy inflation protected bonds. Additionally, treasury bonds, including tips, can be purchased directly. You can buy them electronically via treasurydirect, with an individual limit of $10,000 per person per calendar year. Because they adjust for inflation, tips interest rates tend to be much.

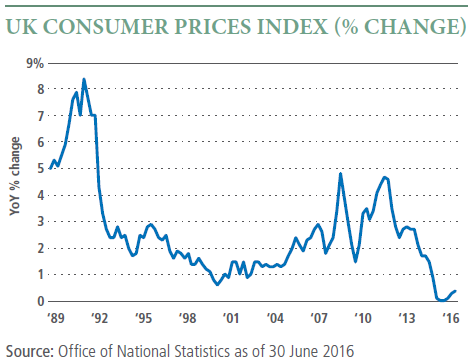

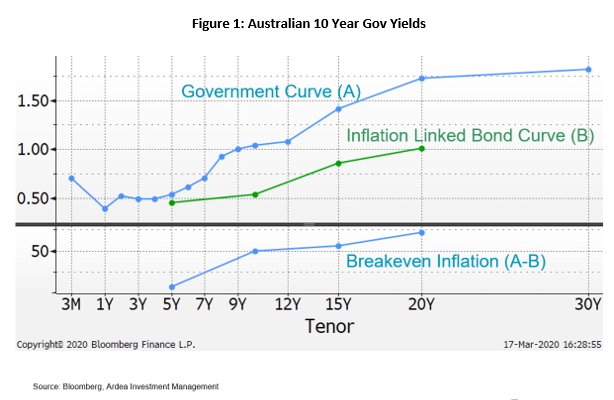

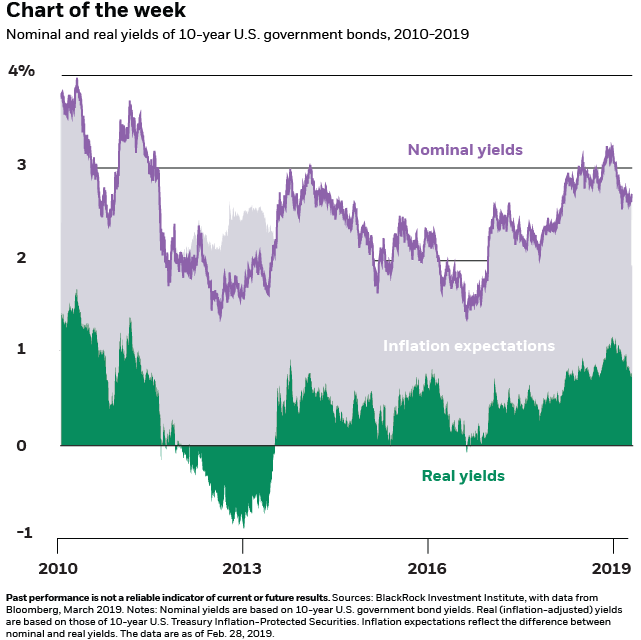

Bonds generally offer a series of fixed interest payments that represent a percentage. When inflation outpaces the breakeven point of normal bonds, it’s usually the right time to switch to tips. Before buying your tips, though, be sure to compare current bond yields to expected inflation rates.

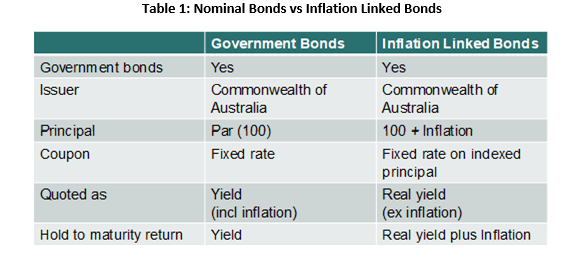

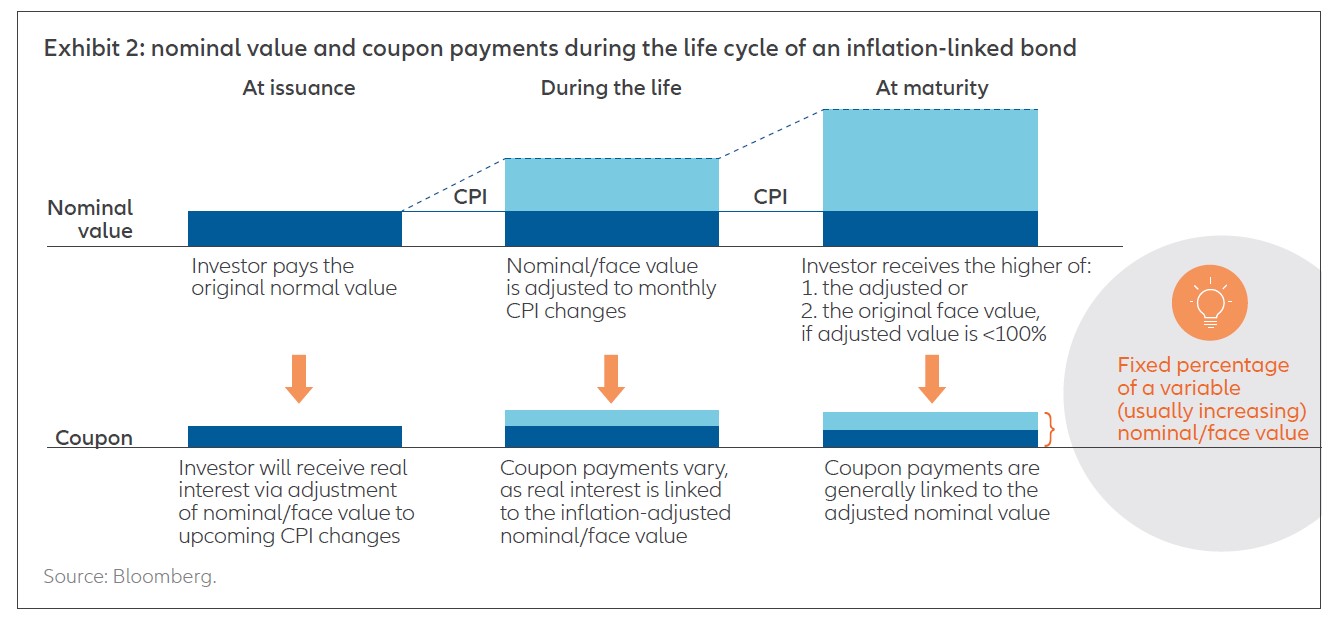

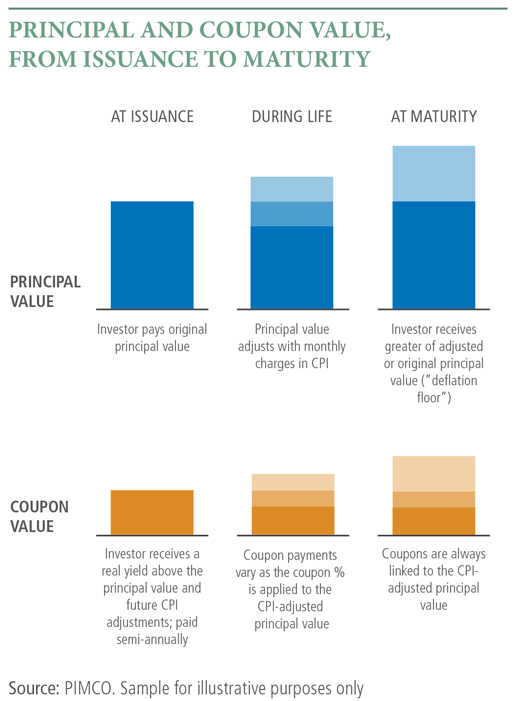

The principal of a tips increases with inflation and decreases with deflation, as measured by. Treasury inflation protected securities (tips) can be purchased through any broker, brokerage account or mutual fund. You could get them directly from the issuing entity, a broker, or invest in.

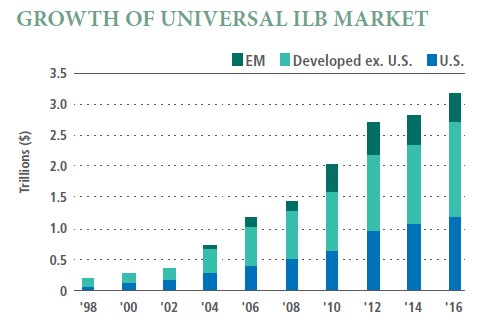

Ilbs decline in value when real. Treasury bonds designed to keep up with the rate of inflation. You can acquire in a calendar year:

The breakeven amount is the difference in yields. If nothing happens to prices, you would earn $10 at the end of the year. How to buy treasury inflation protected securities.

Cpi and sold by the u.s. You can only purchase up to $10,000 in electronic i bonds each calendar year. We focus on three etfs that provide exposure to.

There are two ways to buy i bonds.

Insight/2018/5.2018/05.02.2018_InflationLinkedBonds/Inflation%20linked%20bond%20market%20by%20country.png)