Best Of The Best Info About How To Sell Bonds

You can sell back your i bonds through the federal government’s treasurydirect site or by snail mail via its treasury retail securities services.

How to sell bonds. Stocks have started to spread worldwide the volatility in u.s. Annual interest + anually accumulated discount/ average of par value and current price x 100. Send your bonds to us, along with fs form 1522 ( download or order ).

The initial interest rate on new series i savings bonds is 9.62 percent. Selling treasury bonds you can hold treasury bonds until they mature or sell them before they mature. You can buy bonds from an online broker.

Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. China’s government is expected to sell bonds worth more than $340 billion for the rest of this year, according to bloomberg calculations, as it taps the. The existing i bonds already accrued some interest.

You will need to validate your identity. So there is no reason to sell old i bonds. South korea plans to sell nine trillion won ($6.25 billion) of treasury bonds through auctions in october, the finance ministry said on thursday.

If you cash only a portion of the bond's value, you. You can buy i bonds at that rate through october 2022. You have a few options on where to buy them:

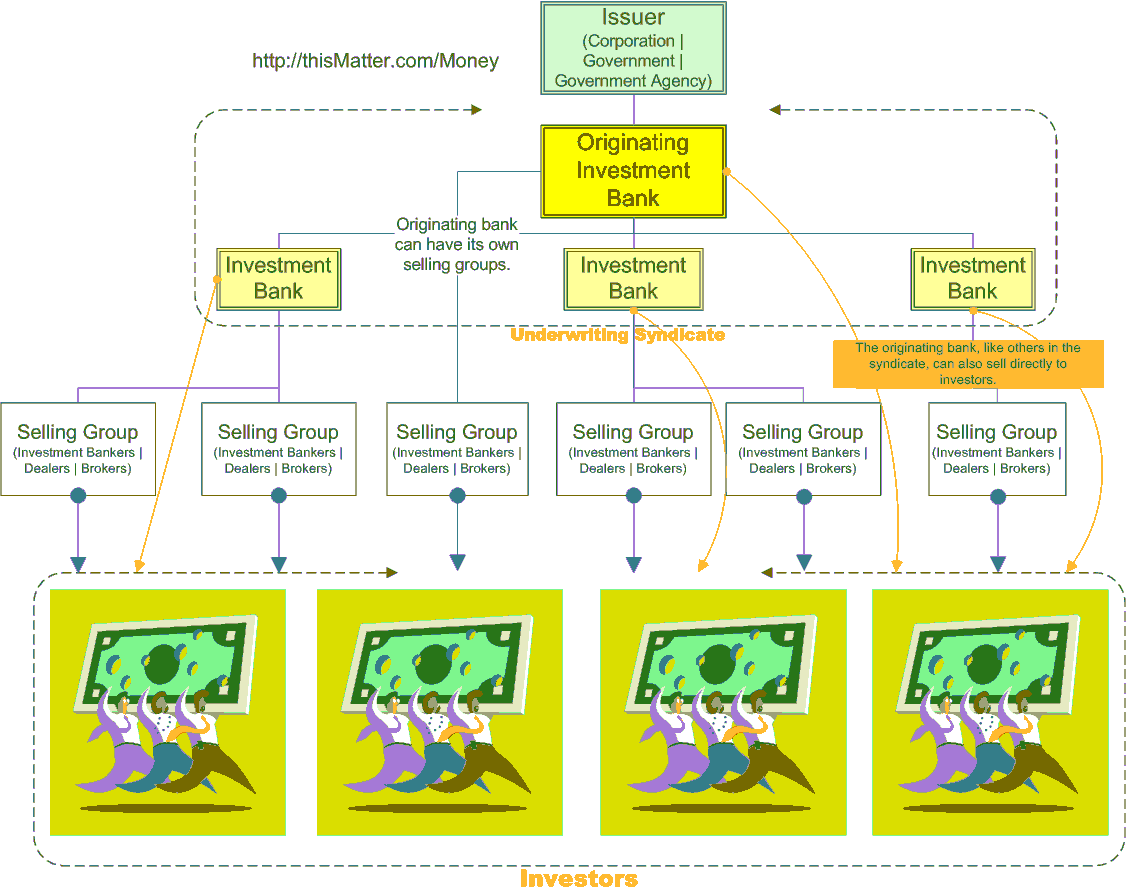

Boe might have to extend bond purchases with ongoing market volatility. Selling them now will trigger paying federal income tax on the accrued interest (i bonds are exempt from state and. Treasury and savings bonds may be bought and sold through an account at a brokerage firm, or by dealing directly with the u.s.

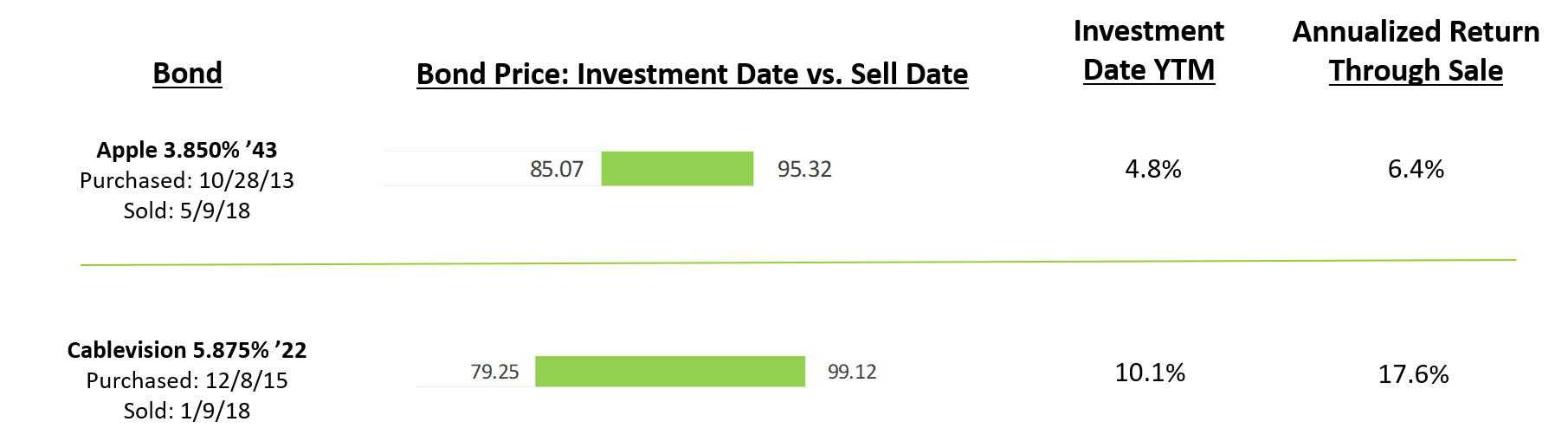

If you want to sell your bond before it matures, you may have to pay a commission for the transaction or your broker may take a markdown. a markdown is an amount—usually a. If tennant calls the bonds from may 1,. To sell a treasury bond held in treasurydirect or legacy treasury direct,.

If you cash only a portion of the bond's value, you must leave at least $25 in the. You don't need to sign the bonds. New issues of treasury bills, notes and.

Markets is rocking stock, bond and currency trading in other countries. When you buy a bond, you are lending. But you can approximate the yield to maturity with the following shortcut formula:

You can also try cashing in. Download, fill out, and sign the bond order form. Fs form 1522 tells how;

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

/how_brokers_are_compensated_for_selling_bonds-5bfc341f46e0fb0026030982.jpg)

/3_signs_its_time_to_sell_your_bonds-5bfc390246e0fb0026053493.jpg)