Simple Tips About How To Start Partnership Firm

The partnership firm must be formed for any.

How to start partnership firm. Depending on the size of your business, you may be required to. Essentials for a partnership firm: Amount of equity invested by each partner.

10 hours agoabsa bank deepens support to startups, smes with youstart partnership. Before you go into a partnership step one: We can help you too!

This document, the partnership agreement, details ownership and responsibilities. Adding partners in a business improves pace of work and helps to achieve altitudes in industry.few tips sho. You want to be able to articulate with specificity why this particular person or people.

Ensure that it's something all. A partnership and its partners pay tax differently. Make decisions about partners you may be starting your partnership with one or more other owners.

The general partnership as a legal form describes a commercial enterprise run by several personally liable partners. A successful small business partnership is akin to a good marriage. The following are the essential characteristics if you are wondering how to start a partnership firm:

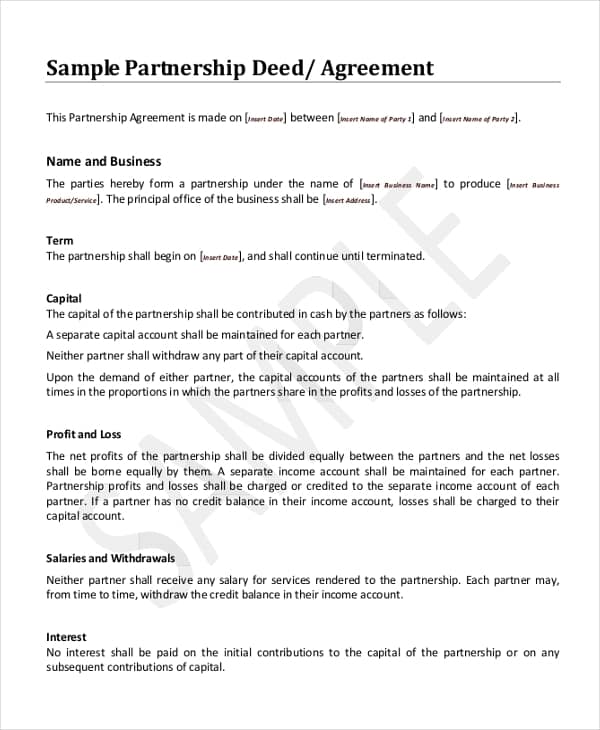

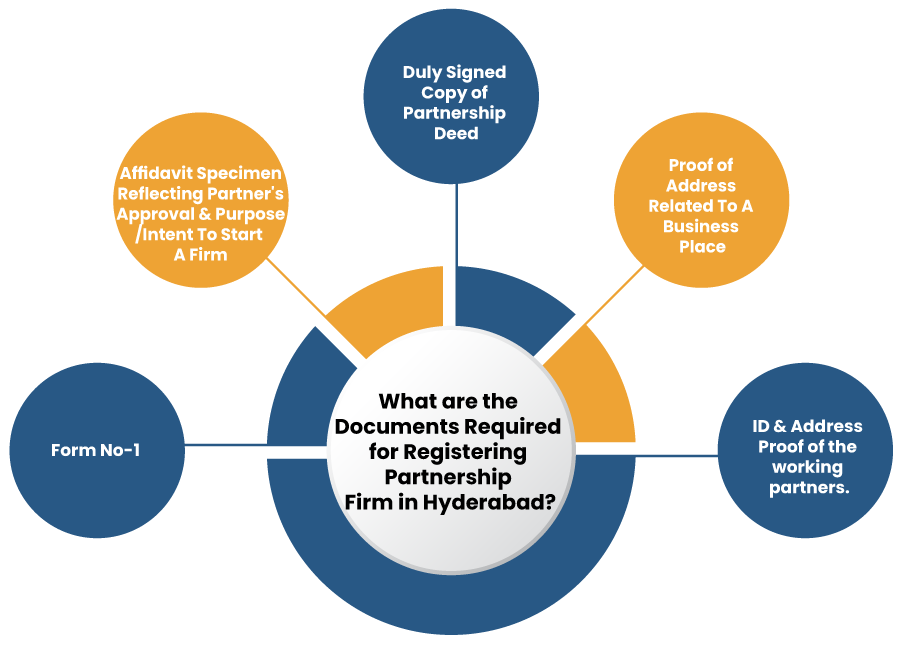

All that it requires for starting a partnership firm is entering in to a partnership agreement between partners. Ad over 2 million businesses have trusted us to help them get started. Steps for starting a partnership firm selection of two or more suitable partners, and an appropriate business name preparation of an elegant partnership deed.

Choose a name for your business choosing a name for your new partnership is a. While other entity types are available to a business with multiple owners, the general partnership. How profits and loss will be shared.

Forming a deed is the first step to building a partnership. The bank’s business in ghana is. All businesses need a name for practical and regulatory reasons, and if you want to register your partnership, then you have to decide on a name.

A limited partnership (lp) is a business entity with at least one general partner (who has unlimited personal liability) and one limited partner (whose liability is limited. The main difference is that a partnership relies on an agreement between the partners. Choose your partners when it comes to starting a partnership, you have to choose your.

Partnerships must have an ird number for paying the business’ income tax and gst. Ad over 2 million businesses have trusted us to help them get started. Getting your partnership off the ground 1.

/Partnership-final-3bbce4d908bf415d8264398949b6566e.png)