Wonderful Info About How To Become A Canadian Chartered Accountant

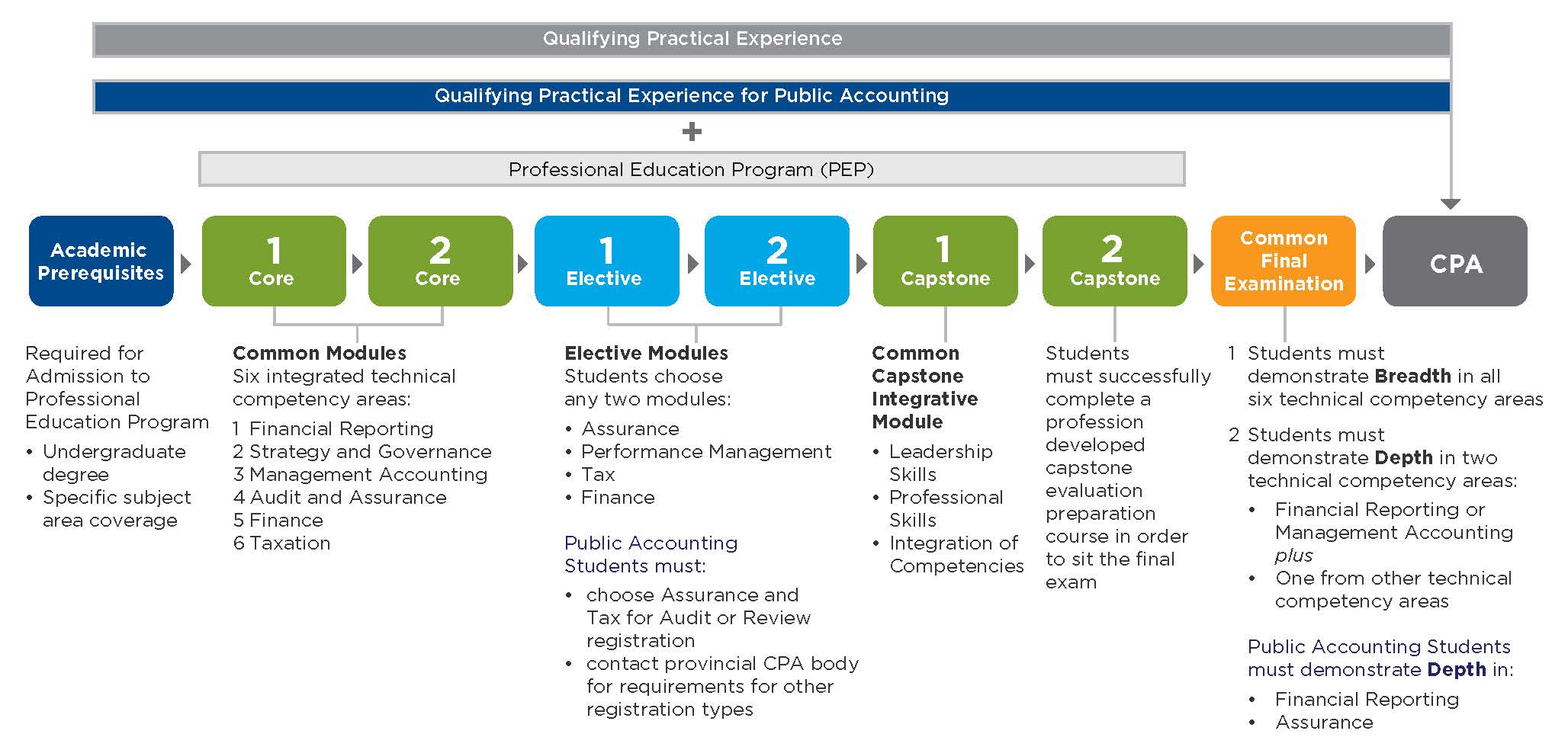

Different pathways can qualify you to become a cpa in canada and take the cpa professional education program (pep), but the default route includes:

How to become a canadian chartered accountant. Obtaining a bachelor's degree in a relevant. You then complete the cpa. To start, you’ll need a bachelor’s degree in a relevant concentration, such as a b.comm with an accounting major.

4 steps to becoming a ca (chartered accountant) in ontario 1. Through your coursework, meet the prerequisite learning benchmarks. How to become a chartered accountant in seven steps.

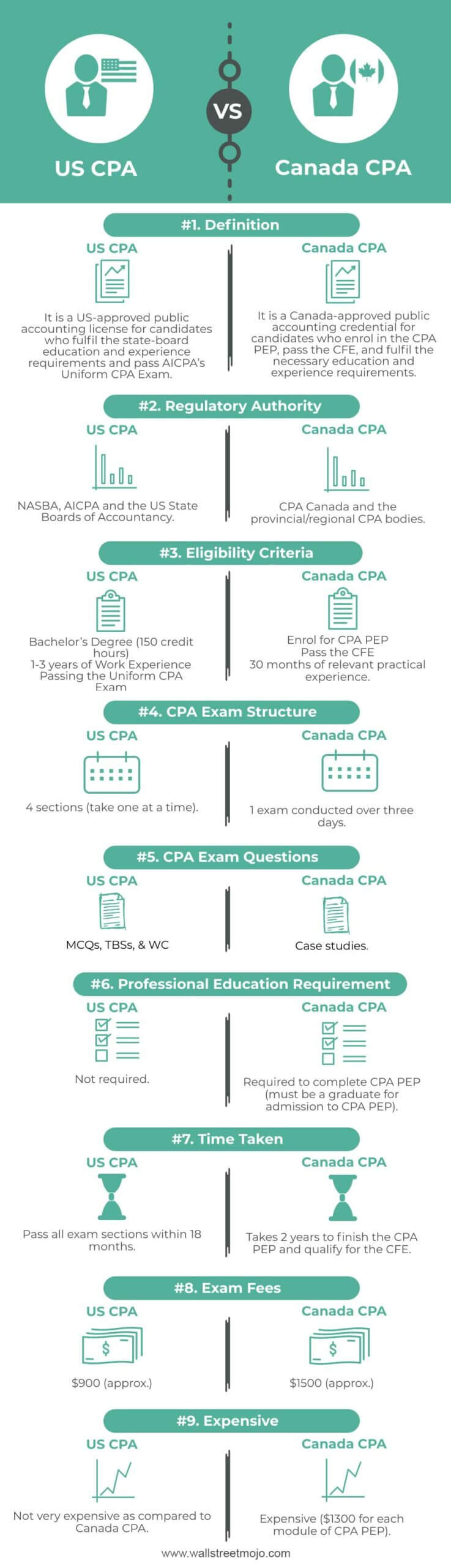

It takes at least six years to become a chartered professional accountant as you first pursue a bachelor's degree, which can take three to four years. Obtaining a bachelor's degree from an accredited program is the first step in becoming a. In order to migrate to canada as a qualified accountant under noc code 1111, you’ll need chartered or regulated status in your home country.

Most students of ca programs comply with the requirement of a. How to become a chartered accountant in canada? Becoming a chartered accountant ca(sa) is your gateway to a challenging and exciting career, global mobility, flexibility, and good earning potential in the business field of your choice.

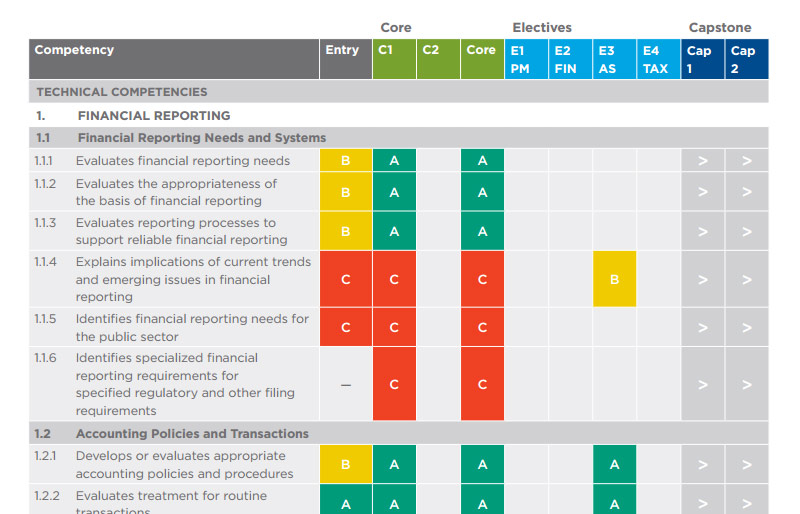

The process by which one becomes a chartered accountant in canada consists of four major components:

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Charteredaccountant_finalv1-8514f65bb8cf4b8685f7b2e8d8554c5a.png)