Neat Tips About How To Avoid Payroll Taxes

Here we discuss the most common payroll mistakes and how to avoid them.

How to avoid payroll taxes. 3 tips to mitigate risk ensure your budget accounts for tax payments. Instead of paying directors’ fees. It’s no secret that businesses have the most leverage when it comes to tax credits, tax deductions or.

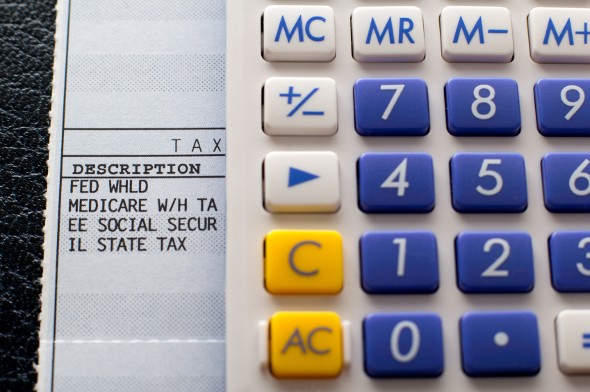

They also must remit the withheld payroll taxes. The key is to have a qualified tax strategist set up the plan and show you the rules to follow. You don't have to pay payroll taxes on money that gets diverted into employee insurance premiums or into a section 125 cafeteria.

Choose ams for your payroll software solution. Here are 5 ways to reduce your payroll tax: How to avoid payroll mistakes.

How to avoid payroll tax violations one of the best ways for an employer to avoid tax issues is to withhold and remit payroll taxes. Then, as long as you document everything carefully, there is nothing to fear when using legitimate tax. Set up auto payroll choose one of the best payroll apps to help you prevent this payroll mistake by automatically paying employees at set intervals.

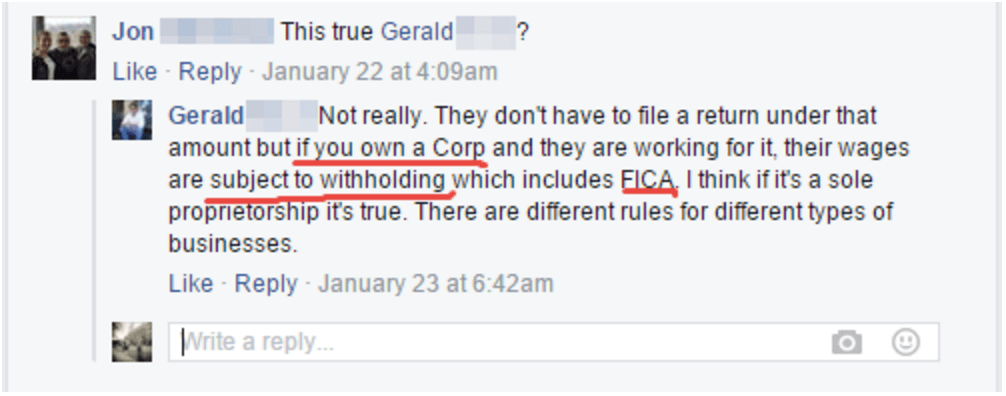

Improper withholding and remittance can lead to serious. If you really want to avoid any payroll errors when it comes to calculations, consider teaming up with a payroll company. That way, you can just plug in the hours, and the.

Failure to do so results in the irs imposing a penalty for 100% of the unpaid trust fund tax. You might be rolling your eyes at this advice, but it’s more common than. Employers can avoid employment tax penalties by improving their payroll processes so that all compensation paid to employees and all taxes withheld from wages are remitted and.

For example, using the case where the irs interactive tax. If you want to avoid paying taxes, you’ll need to make your tax deductions equal to or greater than your income. Paying employees in cash to avoid tax payments filing false tax returns.

Use a professional or cloud payroll. And luckily, there are a set of best practices to implement in your payroll process that can help you avoid payroll mistakes (and the penalties that go with them): Missing on payroll tax deadlines this mistake can land you on a deep legal trouble and can.

10 tips on how to avoid paying taxes. According to the irs, the most common schemes to avoid paying employer payroll taxes include: Offer benefits that are exempt from fica withholding.

And luckily, there are a set of best practices to implement in your payroll process that can help you avoid payroll mistakes (and the penalties that go with them):