Top Notch Tips About How To Find Out Much Tax Return

Try our free and simple tax refund calculator.

How to find out how much tax return. Charlie baker originally proposed a $250 refund, intended for individual filers who earned between $38,000 and $100,000 last year and joint filers who made up to. Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year. Taxpayers can complete and mail form 4506 to request a copy of a tax return and mail the request to the appropriate irs office listed on the form.

Access your individual account information including balance, payments, tax records and more. Use the tax calculator to estimate your tax refund or the amount you may owe the irs. Ad calculate your tax refund for free and get ahead on filing your tax returns today.

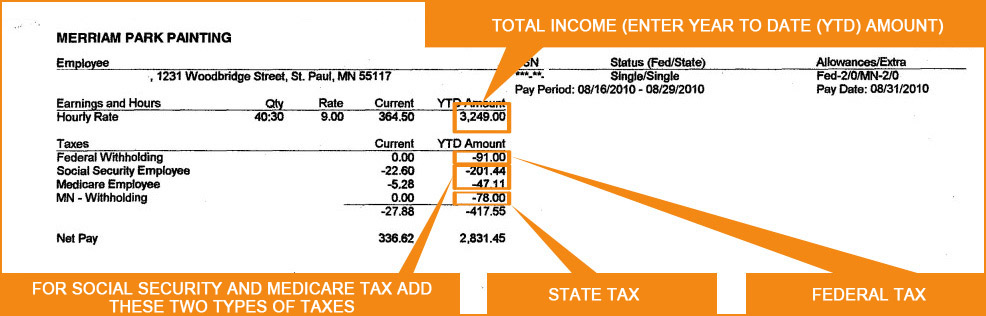

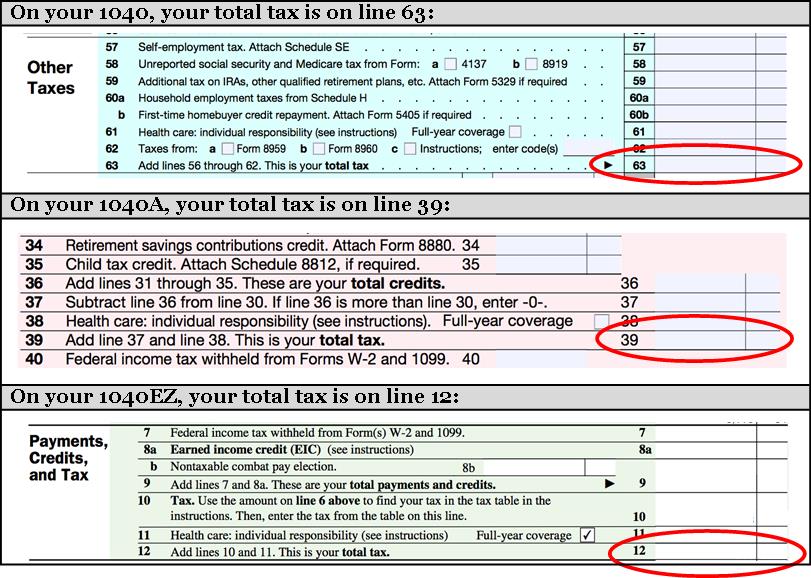

You may qualify to be forgiven for tens of thousands of dollars in taxes Your tax return amount is, in general, based on line 24 (total tax owed) and line 33 (total tax paid). Find state and local personal income tax resources.

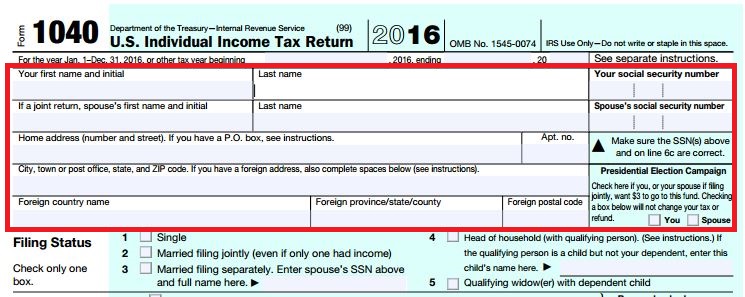

Check your tax code and personal allowance. Once in your account, you can view the amount you owe along with details of. Ad apply for tax forgiveness and get help through the process.

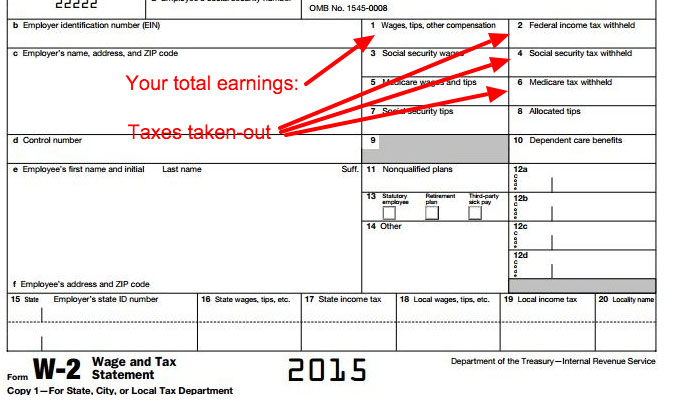

Enter an income to view the. In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. To find out how much you owe and how to pay it, find personal income tax information by state.

Ad enter your status, income, deductions and credits and estimate your total taxes. This service covers the current tax year (6 april 2022 to 5 april 2023). Subtract line 24 from line 33.

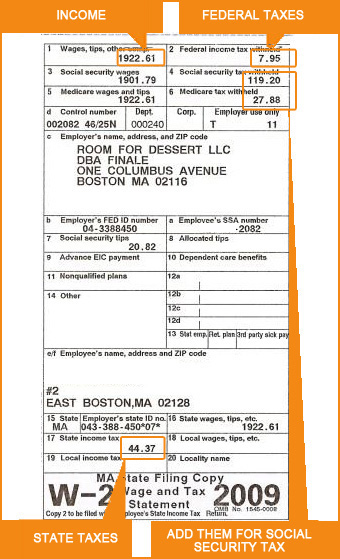

If you have more than one irp5/it3a, please enter totals for all of them added. Next, find your tax bracket, to determine how much tax you. Using the irs where’s my refund tool viewing your irs account.

Did you work for an employer or receive an annuity from a fund? Which tax year would you like to calculate? This calculator will help you work out your tax refund or debt estimate.

Sign in to your online account if you don't have an existing irs username. Use this service to estimate how much income tax and national insurance you should pay for the current tax year (6 april 2022 to 5 april 2023). You’ll need your most recent pay stubs and income tax return.

What’s left is taxable income. (after salary sacrifice, before tax) employment income frequency. There’s a different way to check how much income tax you’re paying this tax year.