Marvelous Tips About How To Buy Wheat Futures

Keep your futures learning going.

How to buy wheat futures. The primary use for wheat is flour,. Kc wheats are 34 1/2. What are the best wheat etfs?

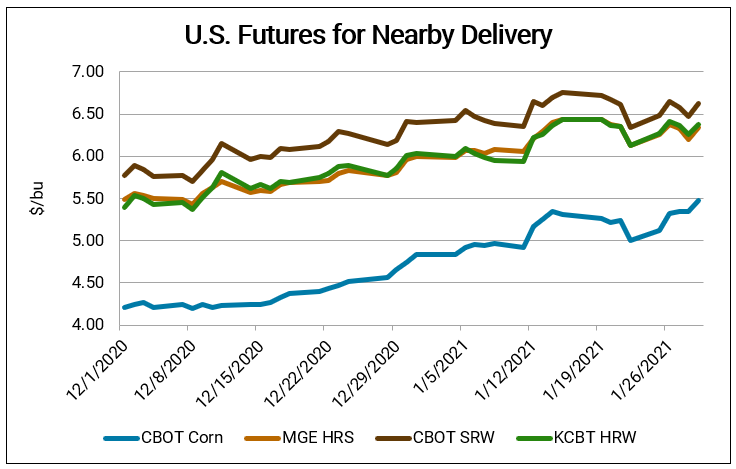

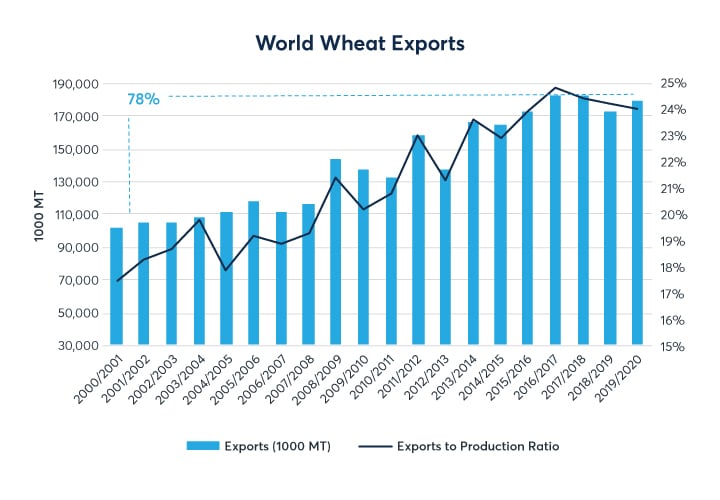

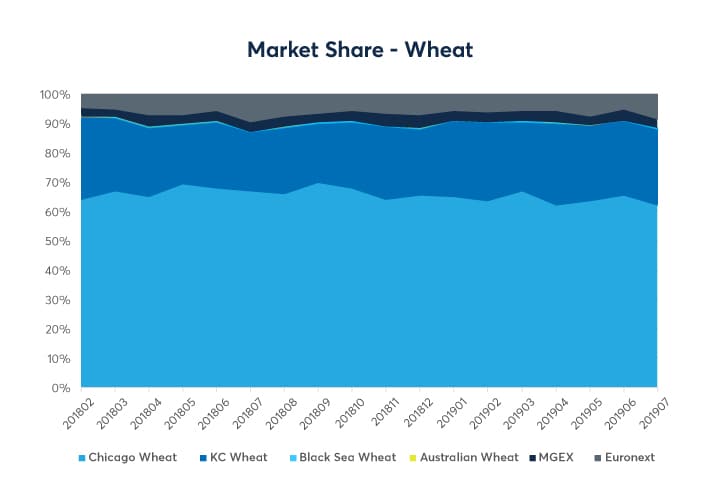

Cbot wheat futures and options contracts provide access to the world’s wheat marketplace. The term wheat futures refers to futures contracts that allow traders to buy or sell a contract today to be settled at a future date. The kansas city board of trade, also part of the cme group, offers wheat futures and options for hard red winter wheat (hrw).

This means that you get to buy the underlying wheat at only eur 150.00/ton on delivery day. Open and fund an account with a commodity futures broker registered with the national futures association to trade grain futures. The holder of a wheat option possesses the right (but not the obligation) to assume a long position.

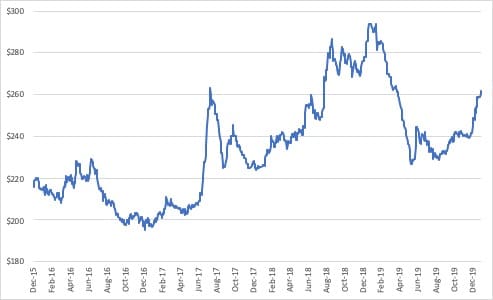

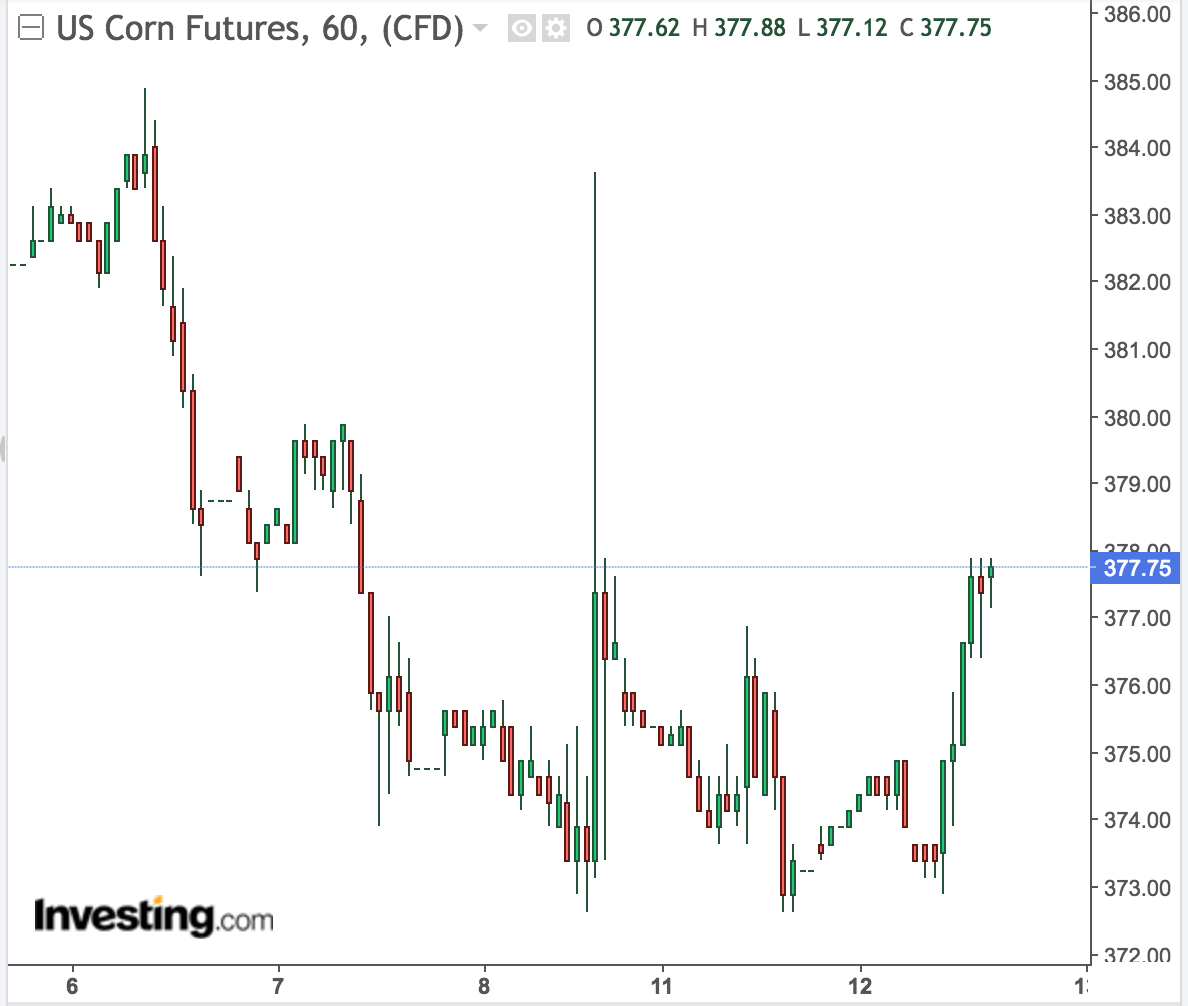

To take profit, you enter an offsetting short futures position in one contract of the underlying. 1/4 cent per bushel ($12.50 per contract) one cent is equal to $50 per contract and $1.00 move is $5000 per contract. Wheat options are option contracts in which the underlying asset is a wheat futures contract.

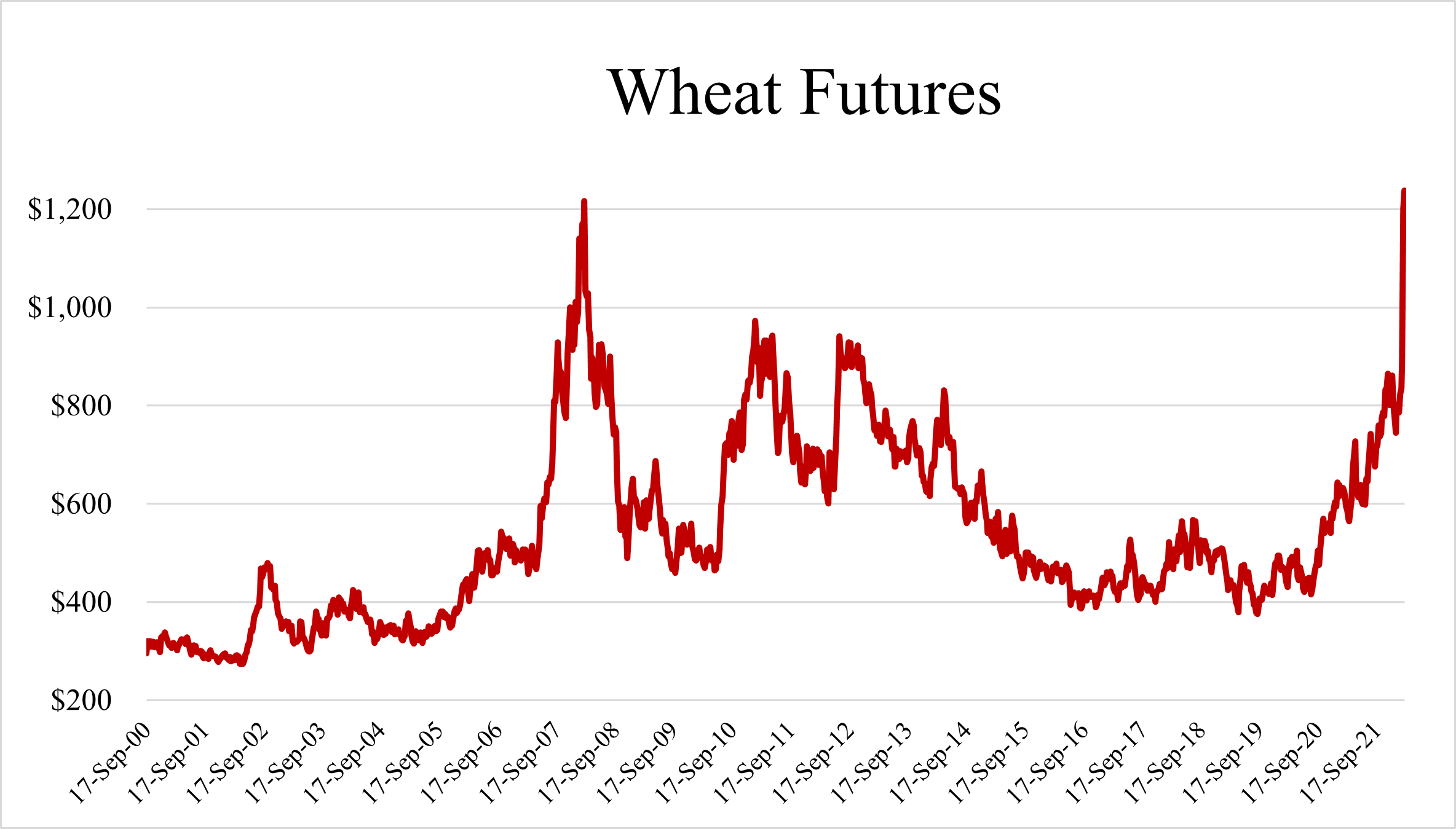

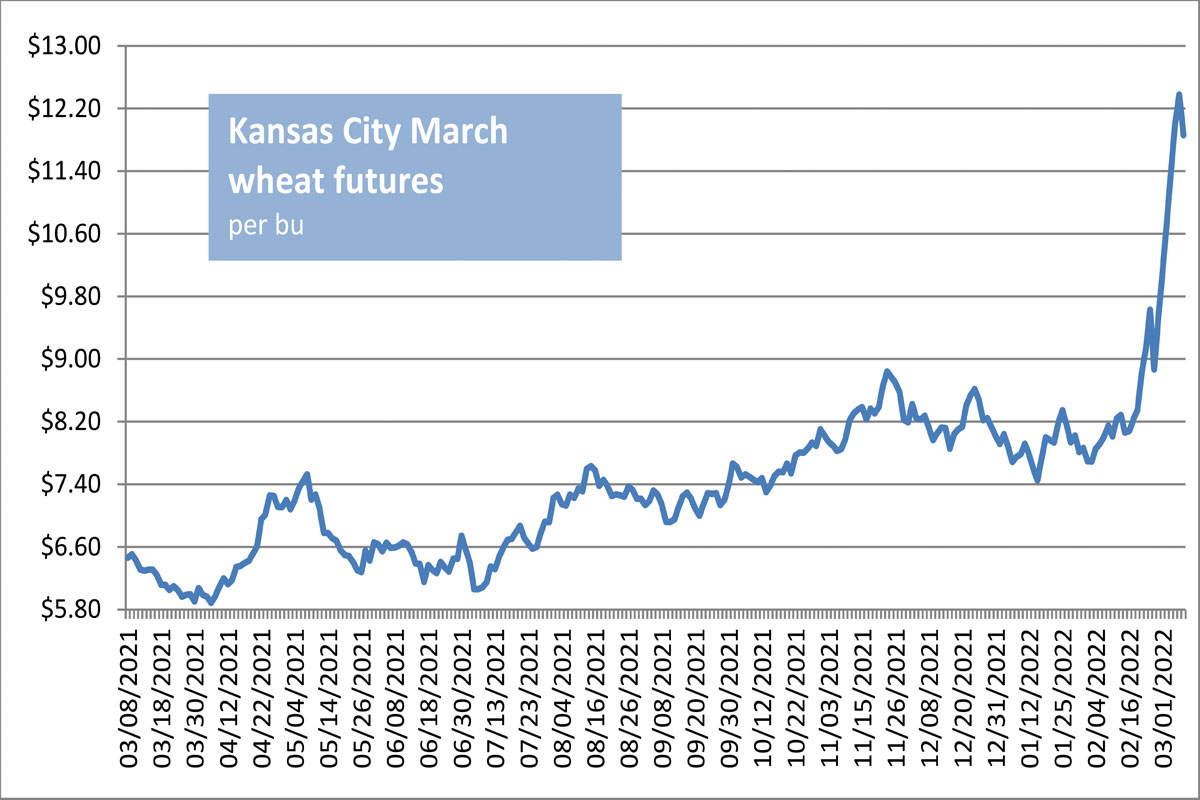

3 hours agoturnaround tuesday in the wheat market has midday quotes back up by double digits. Investing in wheat futures can be risky business, so here's what you need to know before jumping into this market. Conversely, we incur a $1,250 loss if we get stopped out.

Cbot wheat futures prices are quoted in dollars and cents per. If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). Ad start trading futures & get 50% off brokerage fees forever during this limited time offer.

Chicago wheat and kc wheat are the global industry standards for wheat. You can trade wheat futures at chicago board of trade (cbot) and nyse euronext (euronext). Learn more about kcbt and current market information.

Spring wheat prices ended with 16 1/2 to 20 1/2 cent losses on monday. Cbt srw futures are trading +40 cents higher in the front months. It has gained 35 percent in 2022 based on the closing prices on march 18.

Discuss your trading goals with a broker representative.