Heartwarming Info About How To Buy Interest Rate Swaps

Company x could for the.

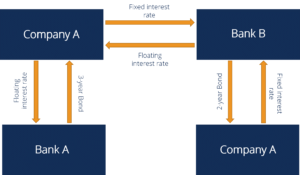

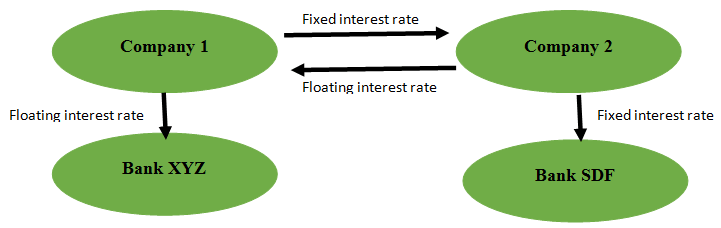

How to buy interest rate swaps. It involves exchange of interest rates between two parties. In particular it is a linear ird and one of the most liquid,. This fee income is recognized in the period the swap is executed and is not.

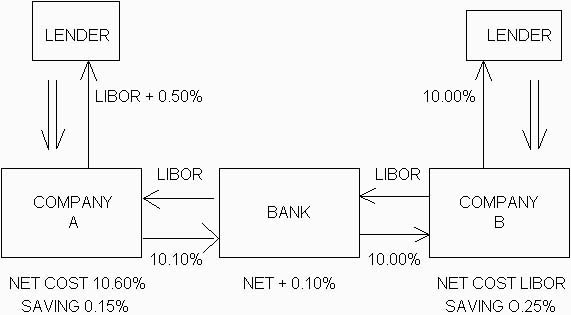

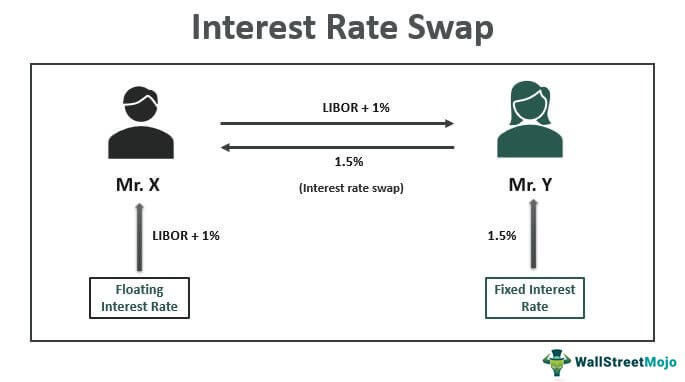

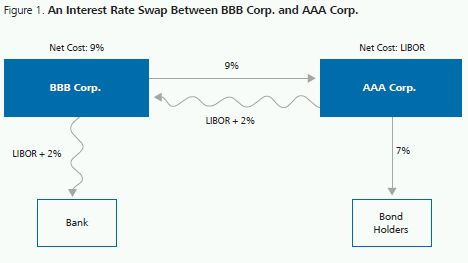

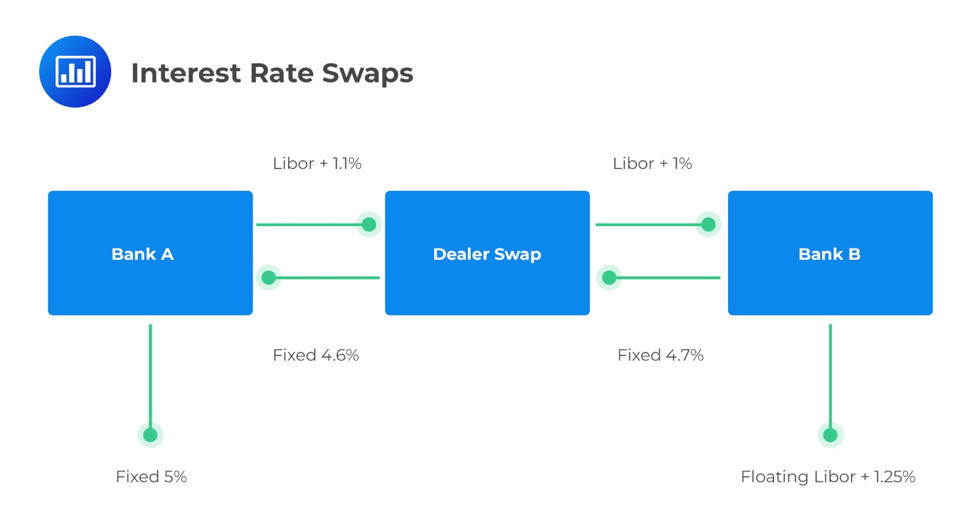

Mainstream banks who has advantage in the long term market and libor traders who has absolute monopoly in the short term market. In the example provided in the table below, the expected interest expense for that forward curve on a 3 year 10 million loan is 130,000. I don't think it can be done at retail level.

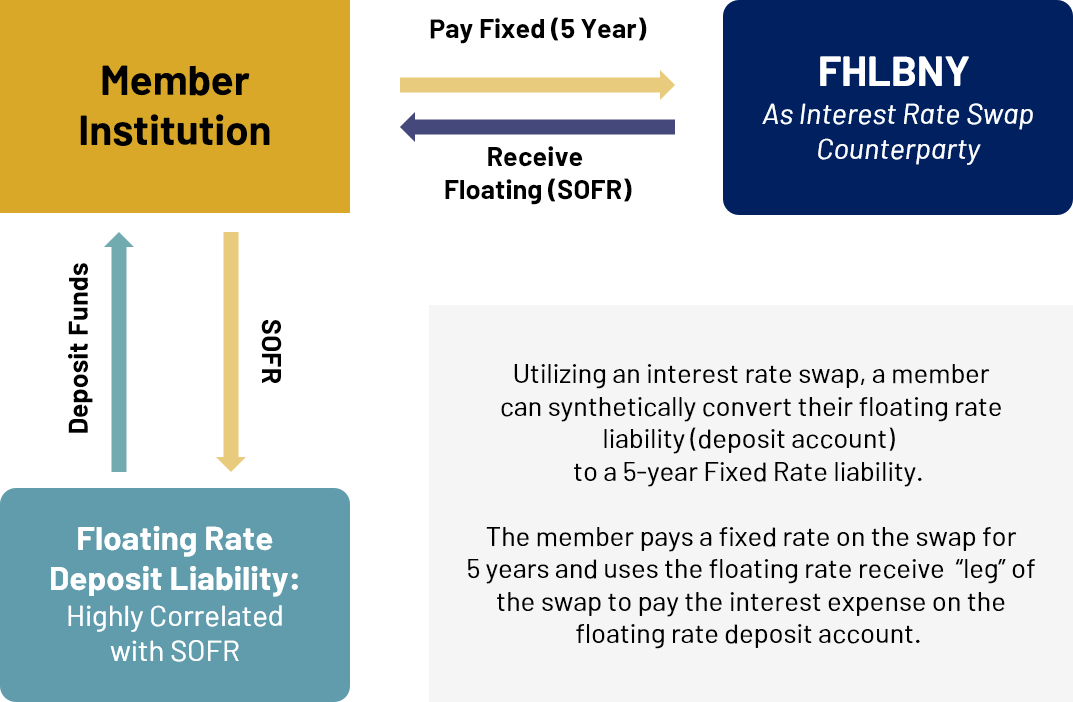

Ultimately, an interest rate swap turns the interest on a variable rate loan into a fixed cost based upon an interest rate benchmark such. How an interest rate swap works. There are four basic ways to do this:

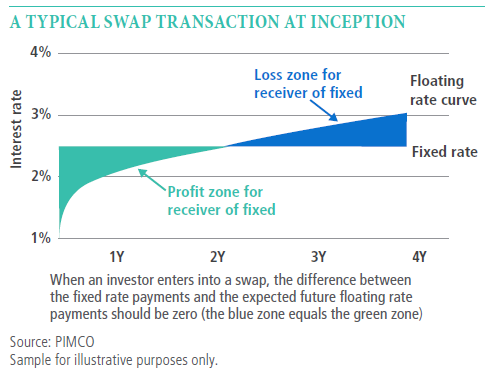

Just like an option or futures contract, a swap has a calculable market value, so one party. The notional principle is the value of the bond. Explanation of interest rate swap.

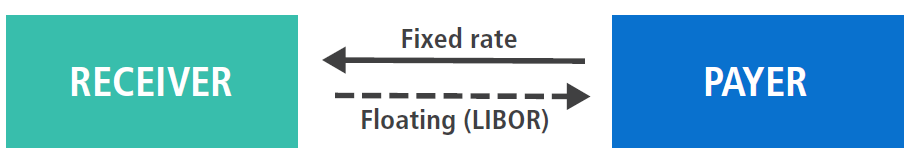

It must be the same size. An interest rate swap is an agreement between two counterparties in which one stream of future interest payments is exchanged for another. The goal of an interest rate swap is to obtain a lower interest rate or one that better suits each party, at least better than what would have been possible without the swap.

With these contracts, entities do not exchange their obligations or debt instruments. The hitch being they would need to issue the bond in a foreign currency, which is subject to fluctuation based on the home country’s interest rates.

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)

/dotdash_final_Currency_Swap_vs_Interest_Rate_Swap_Whats_the_Difference_Jan_2021-01-d0d9bf99a16c467daeab2fd073b67051.jpg)